Crypto Trends for 2022, from Messari's Report

A comprehensive summary of Messari's Crypto Theses for 2022

At Crypto Explained, we are on the mission of making crypto easy for everyone.

If you appreciate our effort, don’t forget to subscribe to receive our weekly Newsletter! I’m grateful for the support!

Last week, I shared an overview about mainstream crypto adoption throughout 2021, explaining why we’ve reached the point of no return, and why we are all responsible to understand what crypto is and how it’s disrupting the world.

As promised, in this last week of the year, I’ll share some key trends entering 2022. I’ll do this by summarizing the main points of Messari’s “Crypto Theses for 2022”, so everything I’m sharing in this article is credited to Messari.

For those of you really invested in crypto, it’s a great 165 pages read, you can download it here. For those of you who find that too long of a read, let me walk you through the key takeaways.

Trend 1 - Why it matters?

Things will get worse before they get better in the “real” world

Let’s recap… The whole foundational problem crypto is trying to solve is based on the collapse of institutional trust, and this collapse will continue.

Inflation, stock market dips, will all have an effect on crypto as well.

Crypto/Web3 is inevitable

The user-owned economy will outperform the monopolist-owned economy in the long term. This necessarily scares the current powerful ones, but we live in a period of social upheaval, where younger generations are keen to invest in technologies that disrupt the old guard.

In a nutshell, decentralized technologies with embedded financial incentives offer a more compelling alternative to decaying legacy institutions.

Trend 2 - on the King (Bitcoin, of course)

Bitcoin has eaten gold’s lunch for a decade. Bitcoin remains the best liquid bet on the institutional rotation to inflation-resistant, store of value assets.

The king stays the king - no flippenings

No matter how much people compare BTC and ETH, they play in different areas: one is set to be the world’s best money, and the other one is aiming to be the world’s best virtual computer.

Bitcoin’s scarce resource is its simple monetary meme. Its pure-play “money” competitors are less intimidating. As regards the likes of meme coins… jokes get old, and when winter comes, you want to hold on to something larger.

Bitcoin Roadmap

It’s unlikely to see bitcoin applications outside of the payments and store-of-value settlement use cases.

The stakes are higher in bitcoin, and ongoing updates and investments in bitcoin’s core code and communications infrastructure show this.

v22.0 connected bitcoin to a second anonymous communication protocol, in order to continue building the resiliency to bitcoin’s secure messaging capabilities, making it even harder to de-anonymize users.

Trend 3 - What are the main areas in crypto?

We’ve seen mind-blowing progress during 2021 in the crypto space, and it’s all coming together:

We have cryptocurrencies (digital gold & stablecoins),

Smart Contract computing (Layer 1-2 platforms),

decentralized hardware infrastructure (video, storage, sensors, etc),

Non-Fungible Tokens (digital ID & property rights),

DeFi (financial services to swap and collateralize web3 assets),

the Metaverse (the digital commons built in game-like environments), and

Community governance (DAOs, or decentralized autonomous organizations).

We should expect growth everywhere across Web3, though three areas are particularly underdeveloped:

Let’s look at each of them in detail below.

Trend 4 - Blockchain Networks

The Scalability Trilemma competition will continue

The scalability trilemma holds that blockchains can only prioritize 2 out of 3 priorities (scalability, decentralization, and security), and that you will always need to sacrifice 1 on behalf of the other 2.

Ethereum had a great year and continues to dominate as the leading chain in the crypto world. However, Ethereum’s blockchain hit its capacity this year. Other Layer 1 platforms have exploded 50-100x in value as investors bet on crypto development to parallelize across new ecosystems and absorb the excess demand.

Other early leaders in the race to dominate Layer 1 (or “Layer 0”), are Solana, Cosmos IBC, Polkadot, and Terra.

Broadly, Ethereum’s competitors are all taking different angles towards solving the “scalability trilemma”.

The future is multichain

Even if Ethereum manages to hold off its largest competitors, it will leak value to the rollup chains it leans on for scalability. ETH sits at ~60% market cap dominance among Layer 1s. That will either fall below 50% in 2022, or its Layer 2 rollup tokens will eat into its growth. Maybe both.

A crypto economy with multiple winners would look similar to the world we live in today, with five dominant $1+ trillion technology companies.

There’s a window of time where this battle for mindshare will play out. We may have hundreds or thousands of application-specific “rollups” or “parachains” or “zones”, but we won’t have hundreds of L0/L1/L2 standards.

Ethereum’s EVM will almost certainly be one of the standards that matter on a consolidated basis for decades to come. Who will be the other ones? Next year will be critical to define this.

Inter-protocol bridges will be key

All of these new blockchains (plus Ethereum’s Layer 2 rollups) will need to talk to each other, and the most acute pain point in crypto today may be the lack of bridges.

If the future is multi-chain, then those who build better cross-chain connectors and help move assets fluidly across parachains, zones, and rollups will inherit the (virtual) earth.

TREND 5 - NFTS

To understand the basics of NFT, read here.

NFT core infrastructure will be one of the hottest areas

If a big part of our future lives is spent living in global, virtual, interconnected worlds (the metaverse), then NFTs are some of the primary building blocks for everything in that world.

Marketplaces, financialization primitives, creator tools, community-oriented business models, and decentralized identity management/reputation management systems are all in their infancy.

It’s not about individual assets. Almost all of the smart folks in crypto agree that most NFTs will go the way of most 2017 ICOs...to zero. But some early projects will succeed at a tremendous scale, and the asset class as a whole will explode over the next decade.

Digital Art’s future

Physical art is a $1.7 trillion asset class with ~$60 billion of annual sales volume, and NFTs are still less than 1% of the physical art market, and digital art is just one-tenth of the total NFT market.

The prediction here is that the digital art / NFT market crash will eventually be even more nauseating than the 2015 bitcoin bear market (because these are highly illiquid assets by definition), but the 10-year trajectory of the overall market will be the same: 100x+.

PFPs (Profile Pictures), our digital avatar

PFPs derive their value entirely from their early communities and their memes, which have exploded to $5 billion in sales through Q3 in 2021.

It makes sense that we’ve seen interest and enthusiasm for PFPs take off. They are perfect for the emerging metaverse.

As Fred Ehrsam told Vanity Fair: “Imagine you live on the internet. The way the world primarily knows you is not through your face or your clothes—it’s through your digital avatar. Of course you are willing to spend”.

Fan Tokens will play a critical role in mainstream adoption

Fan tokens are simply collectibles with member rights. Those rights can be financial (tickets, shared royalties), or non-financial (social signal as a super fan, experiential access), or a combination of the two.

Fan tokens, could be what helps crypto cross the chasm into mainstream adoption as more tribes become owners.

Fan tokens unlock a whole new value stream for the rest of the entertainment industry (film, music, sports in particular), democratizing and breaking the stranglehold that LA has over film and music, better connecting up-and-comers, growing the pie for all creators, and slashing LA producer “take rates” by 50-75% or more.

P2E (Play to Earn) is here to stay, and will likely go nuts

I mean… the amount of money these platforms have raised is nuts, and they’re set up for a full cycle of iteration and development regardless of whether the sector’s frenzy subsides next year. a16z poured $150 million into Mythical Games. Enjin announced a $100mm gaming fund. FTX and Lightspeed invested $21 million in Faraway Games. On the same day.

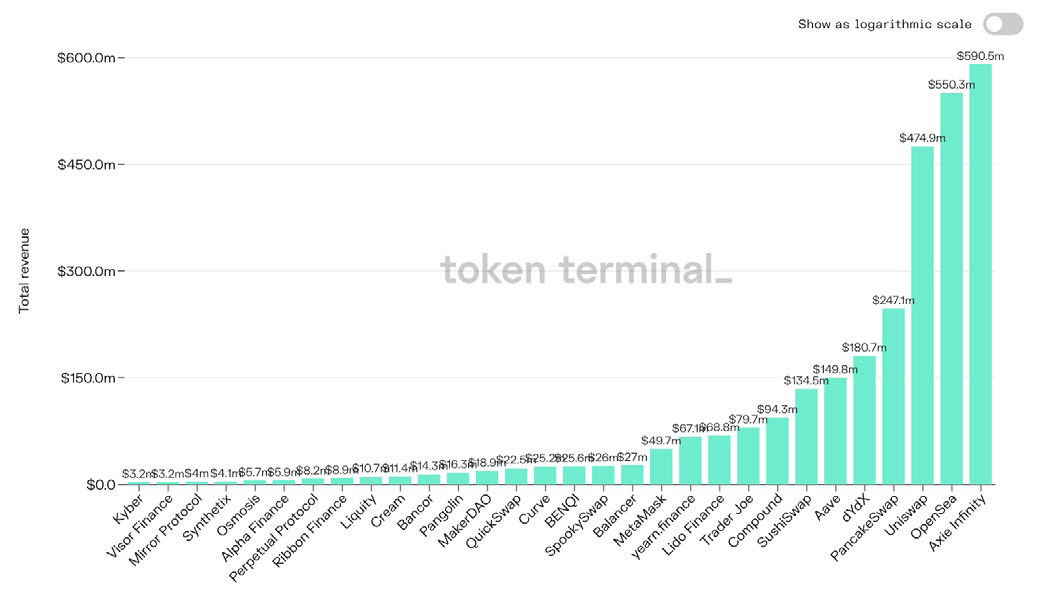

Consider the economics of Ethereum’s top three revenue-producing apps in the past quarter: Axie, OpenSea, and Uniswap.

Axie and OpenSea both generated more than $500 million in revenue in this time frame. Uniswap was next with about $475 million. After that, both Axie and OpenSea were each larger than the next five Ethereum applications combined.

The bet is that a top five gaming studio enters crypto in a meaningful way next year, most likely via M&A of other Web3 games. The benefits of being early on a ten year trend will prove too compelling for all of the market leaders to sit on their asses.

Opensea & NFT marketplaces trend

Numbers like Opensea’s is probably why Coinbase plans to enter the market, and so are other key players lie FTX, Gemini, and even legacy companies like GameStop.

This is good news. More of a validation of the size of the emerging NFT asset class rather than a bona fide threat to OpenSea’s business.

The potential development would be that OpenSea and virtual good pure plays may dominate in the virtual goods realm, while exchange-affiliated NFT marketplaces dominate on the financialization side.

Or put simply, you’ll buy and sell Punks and Decentraland plots on OpenSea, but you’ll buy and sell FLOOR tokens and mortgage LAND on Coinbase or FTX.

Other areas of development

Credentials: curation markets and token-curated registries as a digital replacement for credentials.

Decentralized domain name services: Web domains made IP addresses human readable, and the same will be true for many blockchain-based addresses.

Data marketplaces, that will make personal data relicensing trivial.

Decentralized Social Network: Web3 social media seems like an inevitability these days.

Physical network: A truly decentralized internet also requires permissionless and censorship-resistant hardware networks that support computation and networking.

TREND 6 - DAOs

To understand the basics about DAOs, read here

If 2020 was all about DeFi, and 2021 was all about NFTs, 2022 will be the year of the DAO.

Because DAOs are one of the most important constructs in crypto, and they will change every aspect of the economy, politics, and probably even your social life in the years ahead.

In a nutshell, cryptocurrencies and NFTs are the digital goods of the new economy, DeFi is the native financial system, Layer 1 networks are the rails that power everything, and

DAOs are how the frontier gets governed.

How we talk about them will change in the coming years. But however they’re defined, they’re gonna be big.

Enabling Tools: Wallets & Staking.

The backbone of the Web3 economy and the wild world of DAOs are your personal wallets, which are sort of like your personal data vaults. These tokens within these vaults unlock your access to the crypto realm, and will only become more important in the years to come.

The “learn to earn” plays will be on the rise

The crypto economy is booming. User minds are melting from the pace of development. And one of the scarcest resources of all is attention and genuine user participation.

For example, Rabbithole offers quests that help users test new products and earn token treasury rewards. It’s a win-win-win for all.

The world is just too big for this to be winner-take-all, so likely the “quest developers” will end up being a lucrative occupation within DAO communities.

Working in Web3

But more than anything, DAOs may present one of the most lucrative ways to build a portable reputation that will persist across projects.

What’s wild about the web3 ecosystem, though, is its global accessibility.

Either way, Web3 token incentives are something that can’t be uninvented. We’ll all work for a DAO someday.

Communities will need to see 100x improvements in collaboration tools.

100x better information flow and decision support tools are needed in order to operate more efficiently than centralized competitors

Governance accountability, community “HR”, user and contributor engagement and communications, etc. are all significant, but surmountable challenges.

Giving communities better treasury analytics would also greatly improve their governance decision making process.

Legal Framework for DAOs

One of the things that is going to be a real challenge to figure out is how DAOs actually work in the real world from a tax, contract law, and compliance standpoint.

For most normal people, fixing the contributor liability issues, and bringing DAOs and their communities into global and local tax, banking, and employment compliance is going to be important.

TREND 7- DEFI 2.0

To understand the basics about DeFi, read here

It’s unlikely that Tether (USDT) will fail or put an end to this crypto bull market.

It’s inaccurate to call Tether a fraud. Regardless of which reason it is that drives people to choose to use USDT, at the end of the day they have to trust it, and the system has worked so far.

What we have to understand is the role Tether plays: a bridge to mainstream adoption.

Tether is the most convenient, although slightly shady bridge that spans the mountaintops of the legacy finance world and the crypto finance world. It’s likely to get replaced at some point even if the terminal date remains unclear.

Other types of stablecoins…

DAI is still the most widely integrated decentralized stablecoin in the industry and the preferred decentralized stablecoin of Ethereum’s DeFi ecosystem.

Algorithmic Stablecoins seems to be coming back to the sector, but whatever effort has been made so far is still too soon to tell and predit output.

Emergence of Non Pegged Stablecoins, such as OlympusDAO. It’s undeniably a complex subject, but it’s interesting to keep an eye on, as so far it’s the best bet this industry has come in terms of de-pegging from the US Dollar.

Multichain future for Defi

The shift to a multichain future is here, and it’s created a massive opportunity for existing DeFi brands to extend to new ecosystems.

Defi 2.0’s Future Development

Authorities are generally not fans of Defi.

The guess here is that things will get worse before they get better, and we’ll see a bifurcation of DeFi into:

CeDeFi (known teams), and

AnonFi (pseudonymous developers).

Additional Three things to keep an eye on:

1) smart contract insurance like Nexus* which became the first crypto insurance unicorn, but certainly not the last one.

2) verified secure smart contract libraries and security as-a-service.

3) smart contract security researchers.

TREND 8 - Investors & Institutions

VC money that flooded into crypto will remain in the space: it will go in, up & down, but never out.

Additionally….

Crypto IPOs and ETFs may be more important for attracting institutions and strengthening crypto’s mainstream narrative than they are for helping retail investors access the returns of the space.

Regarding new public stocks (COIN and BITO), the most relevant benefit for the crypto world is probably the free marketing and insights crypto natives get from their filings.

Trend 9 - Policy and Regulations

Contrary to popular belief or political attack lines, crypto entrepreneurs and investors want a smarter crypto policy, because the existing gray area will get more black and white in 2022, and we must be proactive about good policies.

Governments and regulators are struggling to find balance in crafting effective crypto policy. For countries like the US that have been leading technological innovation for decades, it’s really essential to not lose the window of opportunity to continue with this role.

2022 will be critical to defining US position.

In brief, the crypto agenda boils down to seven key issues:

Ensure financial stability with clear stablecoin rules & careful bank integration

Set clear guidelines on KYC/AML reporting while preserving privacy

Clarify tax rules, and set exchange reporting standards

Create Safe Harbors for community governed tokens

Introduce DAOs as a new organizational structure

Harmonize exchange oversight

Allow for state and city-level experimentation

Lastly, most countries seem keen to continue advancing their central bank digital currency initiatives..

Thanks for making it this far! I hope you got a better perspective about 2022 crypto trends.

If you want to learn more, we organize cohort-based programs where people from all walks of life can come and learn together.