Crypto Spotlight: Solana, the fastest blockchain?

How fast is it, and what's the secret sauce?

At Crypto Explained, we are very excited to share with you two upcoming events:

We are hosting our next Ask Me Anything Session on Saturday 20th Nov at 12pm GMT+8. Come join us! Register HERE

Also, we are launching our 1st Cohort of Crypto Explained School! We are kicking off on Saturday 27th Nov, don’t miss out! Check out all details HERE!

If you could help spread the word with a friend that might be interested, I’ll be very grateful!

This month, we are focused on breaking down for you some of the top cryptocurrencies by market cap. After witnessing Solana skyrocketing, I’m sure a lot of you are wondering what makes it so special:

Solana’s native coin SOL kick off 2021 at roughly $1,6 per coin. At the time I’m writing this article, it’s at a price of around $250,

that’s a whopping 150X in less than a year.

Hold on, first things first… What is Solana?

Solana is a Proof of Stake Blockchain, known as the fastest in the world, with the capability of processing thousands of transactions per second:

Solana was founded in 2017 by Anatoly Yakavenko, who has over a decade of experience at Qualcomm.

The main problem Anatoly is trying to solve with Solana is the scalability challenge in the crypto world.

He believes that this is mainly caused due to the time required to organize transactions in the right way, and he came up with the novel concept “Proof of History” as a solution.

Therefore, Speed is key to Solana. Just as Anatoly said, the goal is to bring this network to the capacity of the New York Stok Exchange.

SOL is its native coin, currently fighting with ADA (Cardano) and USDT (Tether) for the spot of 4th largest cryptocurrency by market cap.

A lot of people say Solana is similar to Ethereum, is this true?

In terms fo similarities…

You can certainly think of Solana as an Ethereum from the point of view of what they do:

both Solana and Ethereum 2.0 (which is where Ethereum is transitioning) are blockchains running on a Proof of Stake mechanism to validate their transactions as well as secure their networks.

they both offer Smart Contract capabilities (read more here), enabling developers the possibility of building projects and applications on top of it.

because of this, just like Ethereum, Solana also has an expanding ecosystem building projects around Defi, NFTs, and DAOs.

However, there are some key differences:

In terms of tokenomics, SOL has its supply

cappedat around 500 Million tokens, which will give it a scarcity value.

Ethereum has an unlimited supply, but with their most recent protocol update, the network has started burning tokens with the creation of every block.Solana doesn’t have a

minimum Staking requirement. However, due to the computational power needed, if you’d like to become a validator of their network you will need to own a very specific set of hardware that can become an entry barrier.

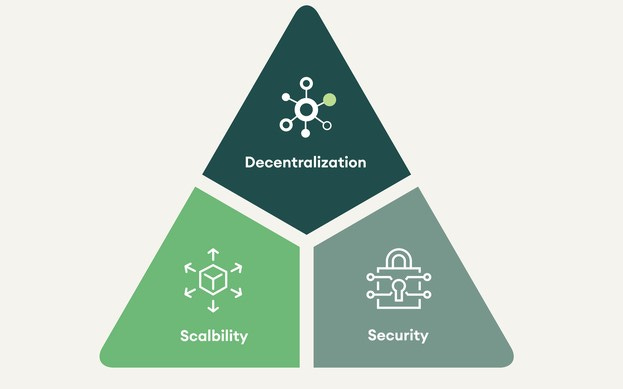

Ethereum has a minimum of 32 ETH of Staking requirement, which at its current price of $4,700 (new all-time high), the required value is around $150K.If we think of the blockchain trilemma (which is the challenge of balancing all three key aspects of a blockchain), Solana definitely focuses on

Scalability, which gives it speed.

Ethereum focuses more on Decentralization and Security of the Network, and is seeking to tackle its scaling challenges and high fees with the launch of Ethereum 2.0.

Wait, but how fast is Solana?

Fast, as in they measure their speed in terms of millisecond block times: Solana currently creates a block every 400 milliseconds, which is 0.4 seconds.

This means every second, 2.5 blocks are created by the Solana blockchain.

To give you some perspective, VISA, one of the leading payment processing networks in the world, currently has the capability of supporting around 20,000+ transactions.

Solana can process more than 50,000(with the potential to reach over 700,000 per second, but is currently limited by hardware). In some sources, this number goes even higher, but just to be conservative, I’m going with the 50,000 which is already more than double Visa.To give you some more perspective, Bitcoin currently does around 4 to 5 transactions per second, and Ethereum can process around 30. (although with the launch of Ethereum 2.0, the number will skyrocket to around 100,000 transactions per second).

How about the Fee?

If there is speed, there is cost-efficiency. If more blocks are being created, there is a lesser competition to be part of a block.

In the case of Solana, it’s not just more affordable: it’s outright cheap.

Currently, Solana claims their cost is lower than $0,01 per transaction, which is crazy compared to Ethereum’s double digits gas fee, which might go even higher in the cases of Defi transactions. (For Ethereum gas tracker, you can use Etherscan here).

What’s the Secret Sauce behind this Speed?

In order to deliver this high throughput and high-speed blockchain, Solana focuses on 8 systems that are core innovations:

Proof of HistoryTower BFT (Byzantine Fault Tolerance) algorithm

Turbine

Gulfstream

Sealevel

Pipeline

Cloudbreak

Archivers

However, the secret sauce of Solana’s speed is really the introduction of Proof of History.

For the purpose of keeping it simple and focusing on what’s most relevant, we will only be explaining this concept.

So, what is Proof of History?

For starters, do not confuse it with Proof of Stake, which is a consensus mechanism. If you want to learn more about it, read here.

Proof of History is actually a method to add the variable of TIME into the blockchain data, introducing a TIMESTAMP to place a specific date and time to each block.

Why is this so relevant?

Well, one of the problems blockchain technology faces is agreement on time, everyone isn’t really in sync with each other at the exact time and this can cause serious issues.

Because of this, computers and servers spend a lot of time going back and forth to agree on this.

What Solana does then, is to remove this step, enabling a very fast sequencing of validators.

This means that, by adding the timestamp, validators can create the next block without having to coordinate with the entire network first because they can trust the timestamp of the order of the transactions they’ve received.

What are some of the trade-offs that come with speed?

Solana’s focus on speed and exponential growth has caused some crashes in the network. Users didn’t care much, but it did raise questions in the community:

December 2017 it went down for 6 hours, which is a little bit offputting as a decentralized network should never go down. This meant that everyone participating in the network had the same bug.

Recently this year, in September 2021, Solana again was down for more than 12 hours.

Despite this, we do need to remind ourselves though that according to Solana, its Mainnet is still at the Beta stage.

Gavin Wood, founder of Polkadot and co-founder and first CTO of Ethereum, didn’t hesitate to express his thoughts:

Final Thoughts

Amazon is a monster in the E-Commerce marketplace, but there are so many other players in the space. Similarly, we will likely have more than one blockchain: different blockchain offers different kinds of value add, community, and opportunities.

Solana lowers entry barriers by offering a solution to key challenges related to pricing and speed. In the initial phase we are at today with crypto, the value proposition Solana is offering is necessariy, and is playing a key role in boosting development as well as global mass adoption.

Thanks for making it to the end! If you enjoyed this article, why don’t come meet me and other like-minded people in the next Ask Me Anything session?