A lot of people compare Ethereum to Bitcoin. It is not uncommon to hear the comparison that if Bitcoin is the digital gold, then Ethereum is the digital silver.

I’d argue that the similarity between both comes from the fact that both are leaders in the crypto space, possessing their own cryptocurrencies, and as such share some of the common attributes, like blockchain technology, decentralization, peer to peer, etc. However, they are very different: each of them impacts and contributes in very different areas of this crypto world. While Bitcoin is considered a store of value, Ethereum is an actual company being built.

Let me share some key aspects of Ethereum, and why it is so special!

Quick Facts about Ehereum

Ethereum was founded by Vitalik Buterin, a Russian-Canadian programmer. Vitalik released the whitepaper back in 2013 when he was only 19 years old, and officially launched Ethereum 2 years later, in 2015.

This means that Ethereum is an actual company, not just a protocol. It aims to be the world’s programmable blockchain, the supercomputer platform that powers the crypto space. In short, it provides a platform for other developers to build their projects.

Ethereum’s native and main programming language is called Solidity, created by co-founder Gavin Wood. It is a procedural programming language that developers use for Smart Contracts, which means a contract/ transaction that will execute automatically once certain predetermined conditions are met, without the need for intermediaries.

Ether (ETH) is the name of its digital coin, and currently is the 2nd largest cryptocurrency in the world, only behind BTC (Bitcoin).

There are currently over 3,700 applications built on Ethereum blockchain, and more than 200,000 developers are using Solidity to build their protocols.

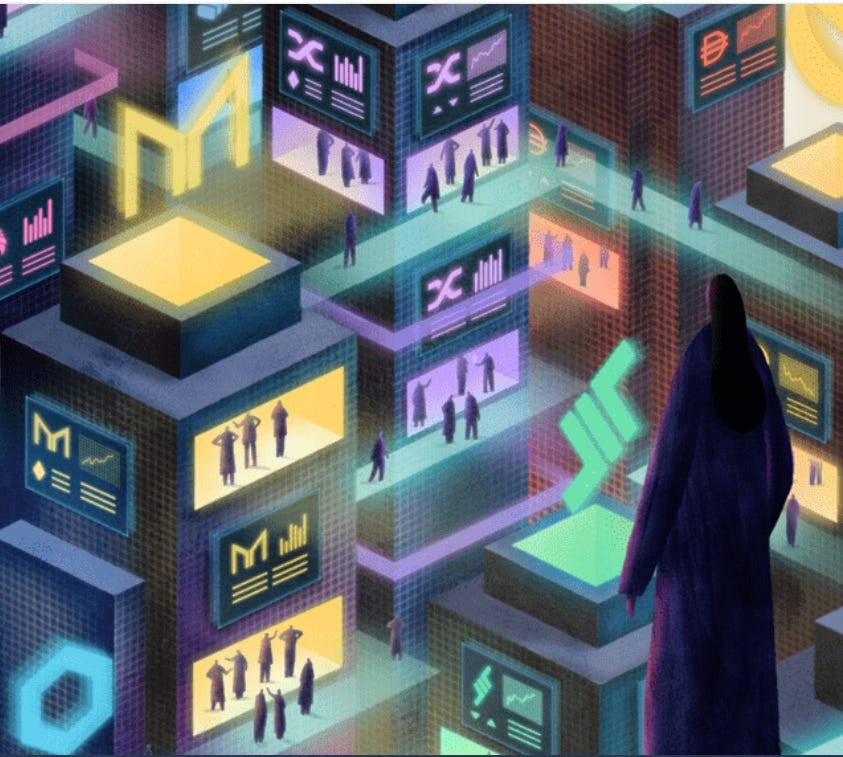

The easiest way to visualize Ethereum is to think of it as a building, with multiple companies occupying it with their offices.If Ethereum is the building, then all the applications created on the Ethereum blockchain are companies that have their offices within that building.

What is Ether (ETH)?

As I mentioned above, Ether is Ethereum’s currency. It can function as a medium of exchange, which means you can own and transfer ETH to other people just as you can do with Bitcoin, USD, or any other currency.

Now, the relevant thing is that, as Ethereum is the network where developers can program and build other applications, ETH is also the currency these applications use to pay transaction fees (Gas Fee). Think of ETH as the fuel needed to run and verify the transactions. Let me explain further.

What is Gas Fee?

“Gas” is a term used to refer to the virtual fuel that one needs to pay as a network usage fee when we send ETH or use an Ethereum application.

This fee is also used as an incentive to the Miners who are the ones responsible to verify that all transactions that happen are within the rules. This is why you might have heard about high gas fee issues, which refers to the fact that if too many transactions are happening at the same time, it causes network congestion as there is only a certain amount of transactions that can be validated in each block. And when this happens, the basic supply and demand rules kick in, the fee increases and the miners can be incentivized to help out the highest bidder first.

How can Ethereum 2.0 solve this scalability issue?

Ethereum is not a finalized static project. Like other tech companies, there is a roadmap to its development, aiming to make it more scalable, more secure, and more sustainable, ultimately becoming more mainstream.

Therefore, ever since its launch, Ethereum has gone through different protocol updates and upgrade to tackle some of the challenges and issues, mostly focused on the congestion and high gas fee mentioned above.

The most recent one was the London Hard Fork upgrade that happened last week (beginning of August). The most relevant EIP (Ethereum Improvement Proposal) is the EIP-1559, which mainly reformed the transaction fee market to reduce fee volatility and increase block size variance. At the same time, it also introduced the mechanism to burn part of the base transaction fee, which means that with every block created, an amount of ETH is being burnt, counterbalancing the increasing supply.

TDLR, when you hear news or people talking about ETH 2.0, it basically refers to the transition of Ethereum into a more scalable and affordable network, which basically means from a Proof of Work to Proof of Stake model (concepts I’ll explain in separate articles).

What type of applications are built on Ethereum?

There are 3 main types of applications that are built on Ethereum network:

Decentralized Finance (DeFi): in a nutshell, it’s just the same financial products and services that traditional institutions like banks can offer, but without the outdated and bureaucratic systems and processes.

These are products built for the internet age, with the aim to open up a global financial system by providing exposure to global markets and alternatives to local banks and currencies. For example, the ability to transfer money directly to somebody on the other side of the world, without the need of intermediary banks and days of delay.Decentralized Autonomous Organisations (DAO): these are member-owned communities without a centralized authority or leadership. Decisions are governed by proposals and voting. It’s like an internet native business, with a safe way to work and collaborate with people from all over the world. The rules are set up by smart contracts, and they can only be changed through voting.

Non-fungible Tokens (NFTs): non-fungible is a term used to describe items that are not interchangeable with others because they are one of a kind and possess unique properties. Because they are one of a kind, what Ethereum network does is tokenize these items and secure them on the blockchain. So whoever owns the token, owns the ownership of these unique items, such as art, collectibles, or even real estate.

As I mention, there are thousands of projects being built on Ethereum’s network. And to follow the building analogy, as you read this article, that building is only growing bigger and higher, generating its network effect to evolve and expand as well.

Very helpful! Could you also do one on Cardano?